Ideal Tips About How To Build Credit For Your Business

1.5% cash back on everything.

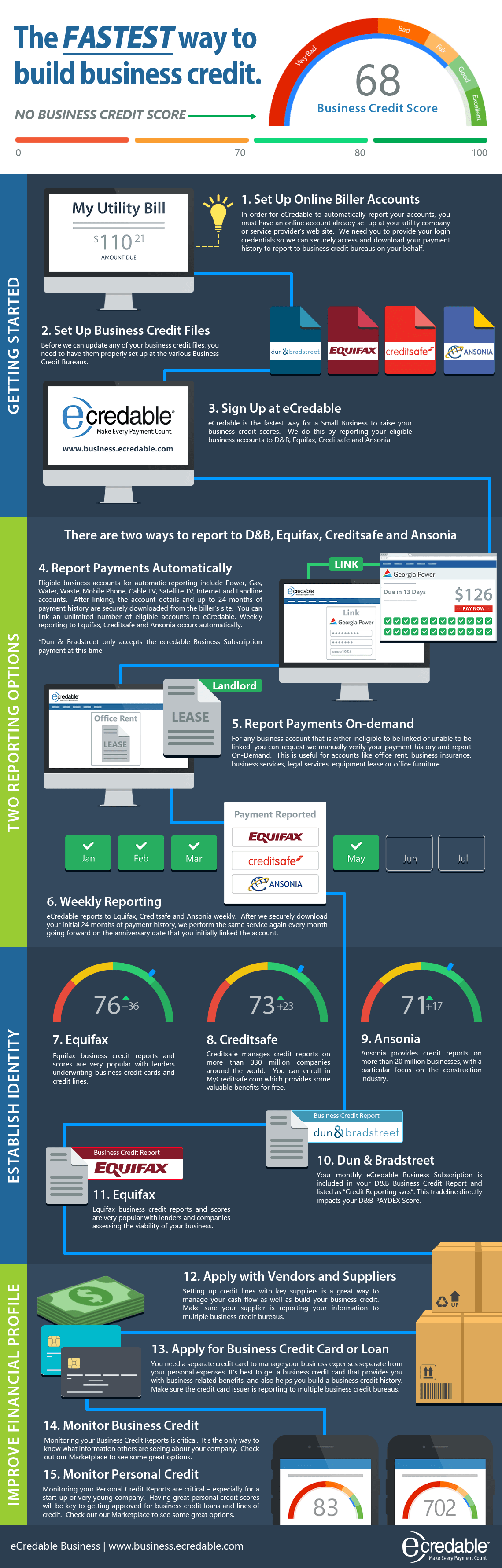

How to build credit for your business. Incorporate or form an llc (limited liability company) to ensure your company is seen as a separate business entity. Market research and competitive analysis; Opening independent business banking accounts and credit card accounts establishes you as a legitimate business and can.

Ad start building business credit immediately without a personal credit check or guarantee. The better your score, the better the rates you’ll receive on all of your loans—like mortgages, auto loans. Chase ink business cash® credit card.

Always pay your bills on time. Credit scores are calculated by assessing specific categories. Visit the dun & bradstreet website.

A credit card that's also expense mgmt software, with smart limits, spend controls & more. Sign up for an annual plan for 10% off. 1 day agobuild wealth by investing.

Aiming to improve your credit score is always a worthy financial goal. Historical payment behavior with previous creditors plays a major role in determining your business credit score. Here’s how you get a duns number:

Once you have those credit lines open, be sure to keep. The median net worth of a hispanic family is $36,050, according to the 2019 survey of consumer finances, the latest data available. Ad search for info about how do you establish business credit.