Marvelous Info About How To Avoid A Wash Sale

There are several ways you can avoid being punished for wash sales.

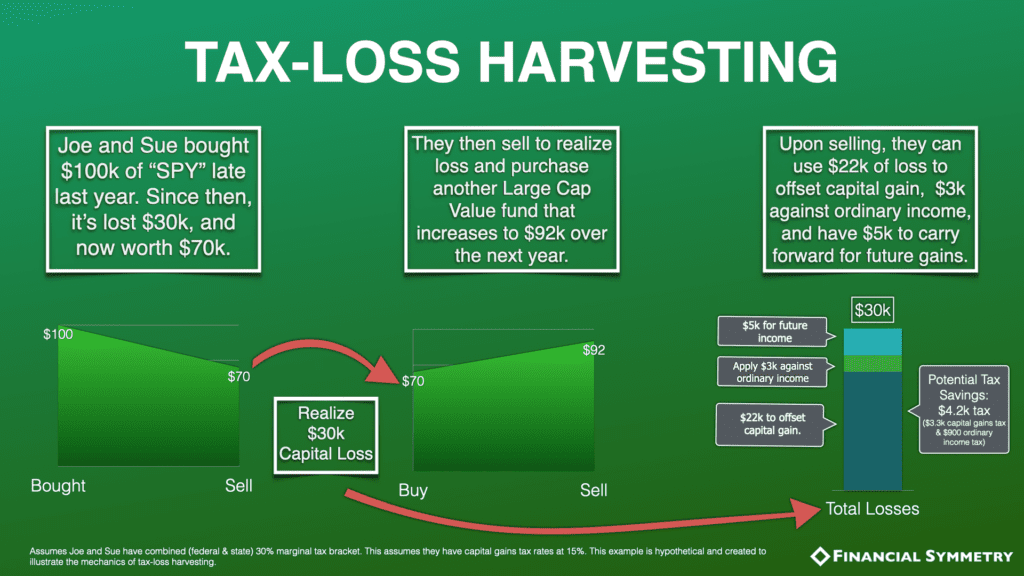

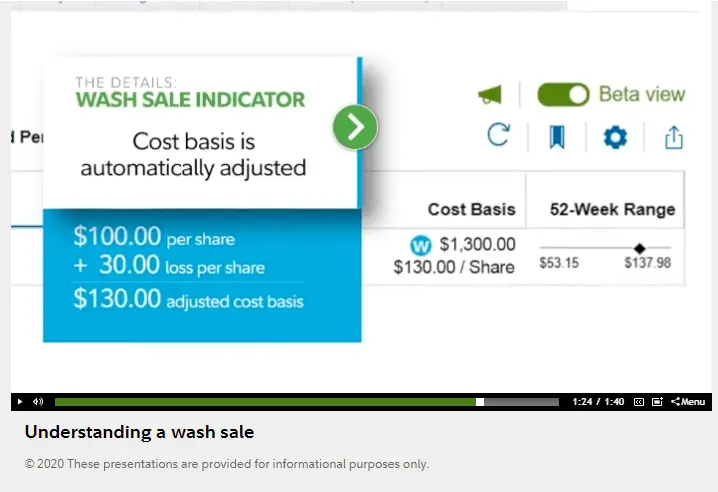

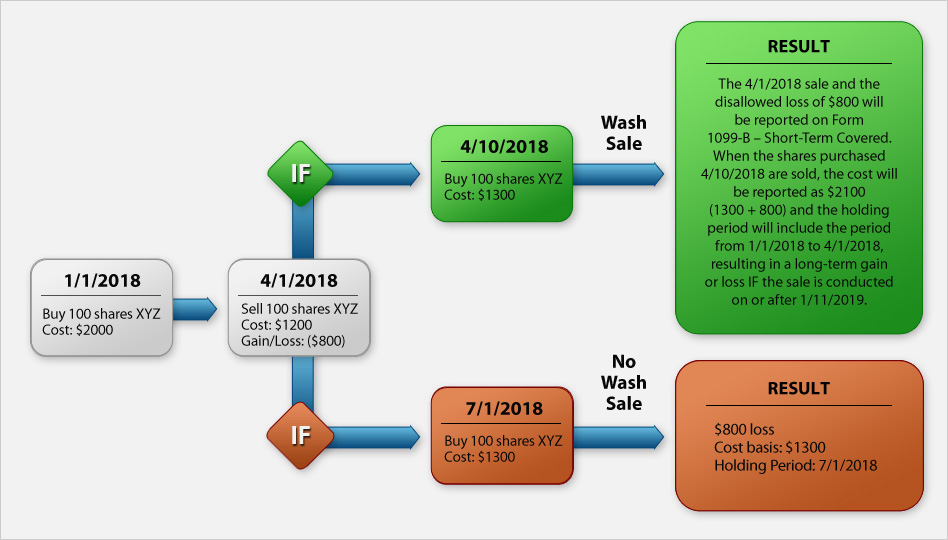

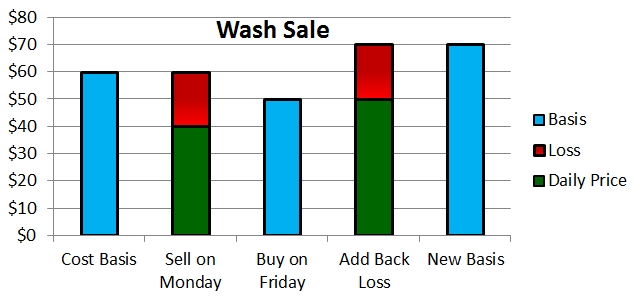

How to avoid a wash sale. How to avoid wash sale rule correlation. This regulation identifies wash sales as selling a stock for a capital loss and then repurchasing the stock or a “substantially identical” security within 30 days. A wash sale occurs when you sell a security in a taxable account and repurchase the same or a “substantially identical” security within 30 days before or after the sale.

Carefully lift the bag out of. The main challenge for the wash sale rule is that it does not explain what an exact similar asset is. This is a loophole that many investors and traders.

How to avoid being punished for wash sales. Wait 31 days to sell shares that have a loss. To avoid having a loss disallowed by the irs because of the wash sale rule, you have a couple of options.

Avoiding a wash sale transaction isn’t tricky. Purchase mutual funds in the same sector. How to avoid violating the wash sale rule.

To avoid a wash sale, make sure to disable this feature 30 days before and after. This will come up again in a few months,. Simply put, you need to wait at least 31 days before you repurchase the same.

It may not be ideal, though. Automatic dividend reinvestments can unexpectedly trigger the wash sale rule for mutual funds. How can you avoid the wash sale rule?

/washsalerule-Final-19587138ed7544388995cbc67e83d4bb.png)